For millennia, the Greek sun grew olives and empires. Today, even as the world retreats indoors to train artificial intelligence and power energy-hungry data centres, that same sunlight is quietly feeding the next generation of growth, clean energy.

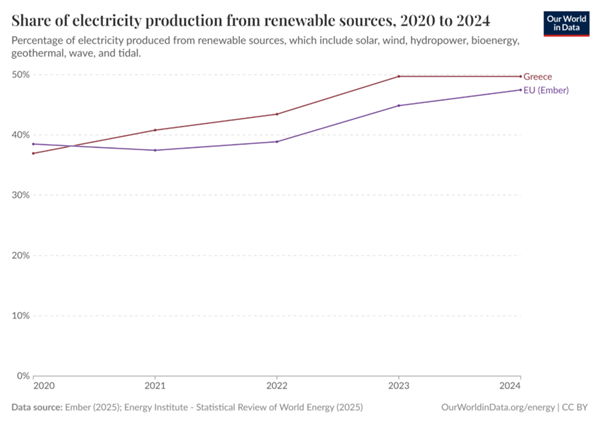

The global appetite for electricity is surging, and the challenge is no longer just to produce more power but to produce it sustainably. Greece is already showing what that future can look like. In 2024, the country became a net exporter of electricity for the first time, with renewables meeting more than half of national demand, slightly outpacing EU demand.

Greece’s Deputy Foreign Minister Harry Theoharis reinforced the country’s commitment to the energy transition and net-zero 2050 targets at the FII9 Conference in Riyadh last week. Theoharis struck an optimistic tone about Greece’s ability to meet rising energy needs with renewables.

“We have a plan to at least generate 75% by 2030, and we believe that we will reach 80%,” he said.

It is an ambitious target, yet one that increasingly looks within reach thanks to a mix of investor confidence, government backing and favourable geography.

That opportunity is being reinforced by policy. On 2 July 2025, Greece passed Law 5251/2025, the country’s first dedicated hydrogen law, establishing a framework for the production, certification and regulation of renewable hydrogen. The legislation aligns Greece’s national framework with the EU Green Deal, REPowerEU and the EU Hydrogen Strategy, giving investors long-term certainty through 25-year producer certificates and clear technical standards for electrolyser projects.

With hydrogen policy now taking shape, Greece’s renewable foundation will be critical to supplying the clean electricity needed to produce green hydrogen.

Solar remains a key part of Greece’s clean energy expansion, with around 300 days of sunshine each year, few countries are better positioned to turn light into lasting value. In 2024 alone, Greece added 400 megawatts of rooftop solar, bringing total distributed capacity to roughly 850 megawatts before the national framework transitioned from net metering to a new net billing model.

So, will the white domes of Santorini soon be capped with solar panels? Not quite, but the image captures the spirit of transformation sweeping through Greece’s energy landscape.

Sirec Energy is helping to drive that change with a leveraged €800 million investment plan designed for both economic growth and lasting environmental impact. In partnership with Survey Digital Photovoltaics, the firm recently financed the industrial rooftop photovoltaic system at Corinth Pipeworks, a 12,000-panel facility covering nearly 60,000 square metres. It is one of the largest industrial rooftop installations in Greece and generates about 10 Gigawatt-hour of electricity annually, supplying a quarter of the factory’s needs while cutting an estimated 4,000 tonnes of CO₂ emissions each year.

The European Central Bank estimates that meeting the EU’s 2030 climate goals will require roughly €620 billion each year in additional green investment. That demand creates a unique opening for private equity firms. As sustainability analyst Sophie McLean wrote for Earth.org, “Private equity ownership allows for longer time horizons that create a broader opportunity to invest in impactful sustainability initiatives.”

Direct control, detailed data access and long-term governance make funds like Sirec Energy well placed to bridge the gap between policy ambition and practical delivery.

At Sirec Energy, that bridge extends well beyond solar rooftops. It spans the systems that make Greece’s transition possible, energy efficiency in industry, cleaner public infrastructure, advanced cogeneration and renewable generation. The same sunshine that once nourished crops now powers factories, cities and a new era of responsible growth.